UK online spending surges to £28 billion in the first three months of 2021

Image source: Adobe Stock

The reopening of non-essential retail and hospitality in the UK on the 12th April marked a significant step forward for two of the UK’s hardest hit sectors: hospitality and retail.

As consumers return to shops, bars and restaurants, the Adobe Digital Economy Index reveals the extent to which the UK has become a nation of online shoppers and how consumers expect the digital shopping habits formed over the past 12 months, to change now that consumers have the option of setting foot in physical shops again.

The findings point to Brits being increasingly purposeful online shoppers – visiting more ecommerce sites, transacting more often and spending more in the first three months of the year than ever before. The significant growth and momentum in online shopping, combined with continued caution around the return to physical stores reaffirms the digital economy is here to stay.

The Adobe Digital Economy Index used Adobe Analytics to analyse tens-of-billions of visits to retail sites from UK consumers in the period January to March 2021, and surveyed 1,000 UK consumers in the last week of March to provide the most comprehensive view of digital buying and selling activity.

Global figures are based on analysis of over a trillion visits to ecommerce sites and direct transaction data of consumers from over 80 countries across three regions (Americas, APAC, EMEA) – more than any other technology company or research firm.

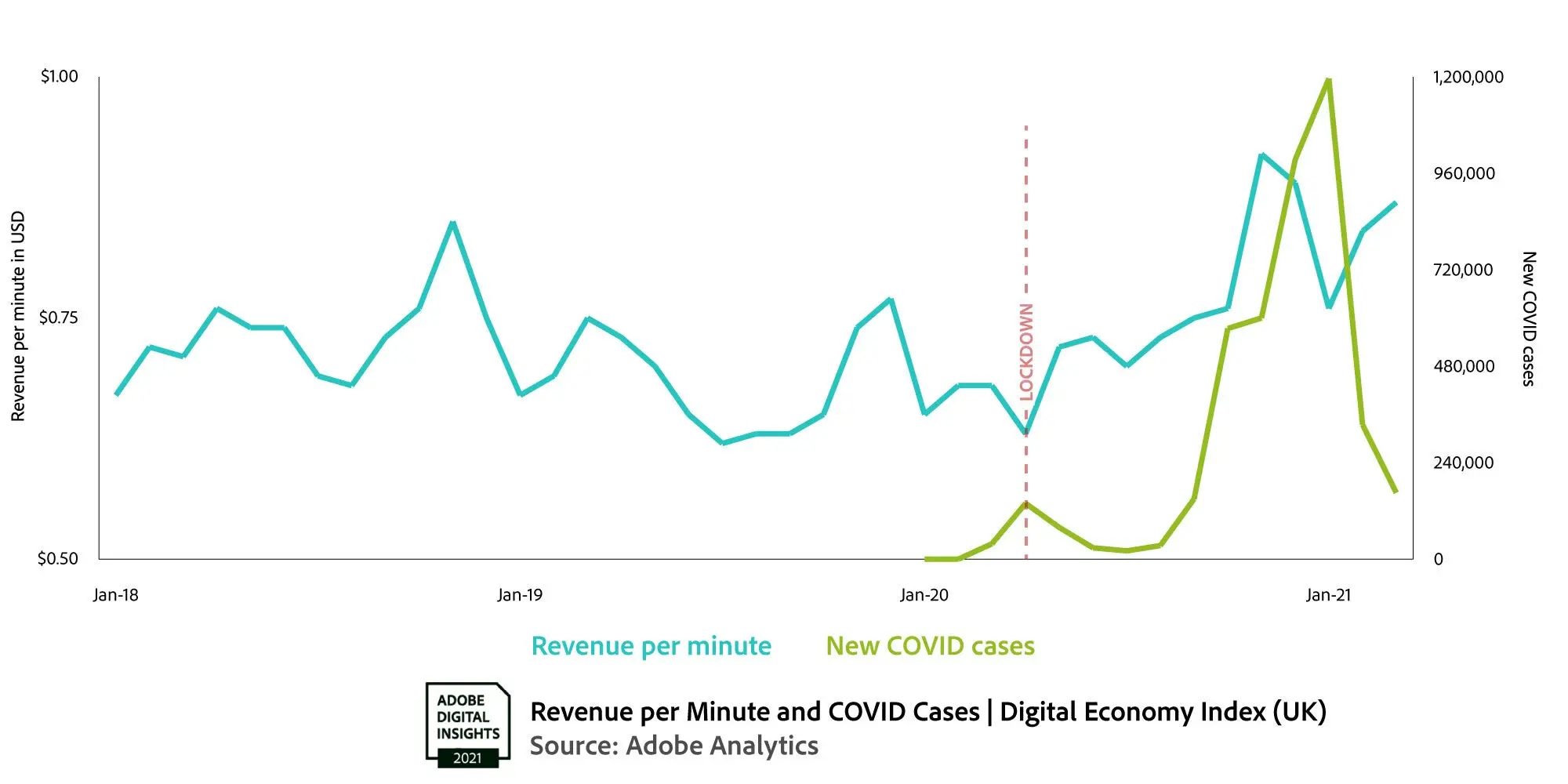

The pandemic continues to cause a surge in online spending around the world, with particularly strong growth in the UK. In Q1 alone, UK Consumers spent £28 billion online, equivalent to £217,000 being spent every minute and up 54% year-on-year.

Adobe Analytics also found that web visits from UK consumers to ecommerce sites grew by 29% YoY and the share of web visits that resulted in someone ordering a product increased by 18% YoY. These figures show that UK consumers are highly proficient and comfortable with all aspects of online shopping from browsing through to check-out.

In Q1 UK online shoppers browsed more ecommerce sites, transacted more often, and spent more per transaction

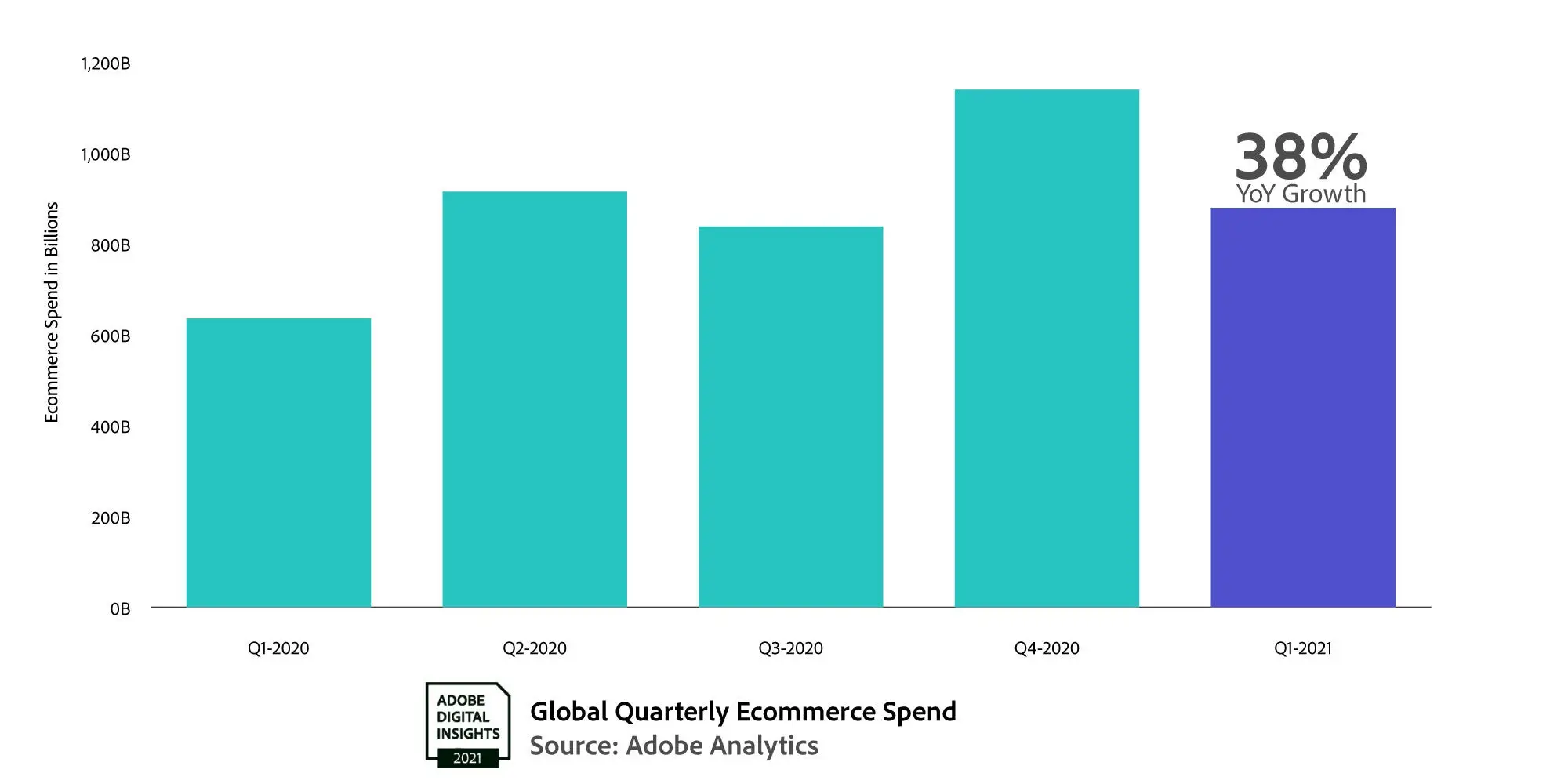

Global online spending surged to £635 billion ($876 billion), up 38% year-on-year in dollar terms. At current growth rates, Adobe forecasts that global eCommerce will hit $4.2 trillion for 2021 – equivalent to the 5th highest GDP in the world.

The Adobe Digital Economy Index survey of 1,000 UK consumers also revealed:

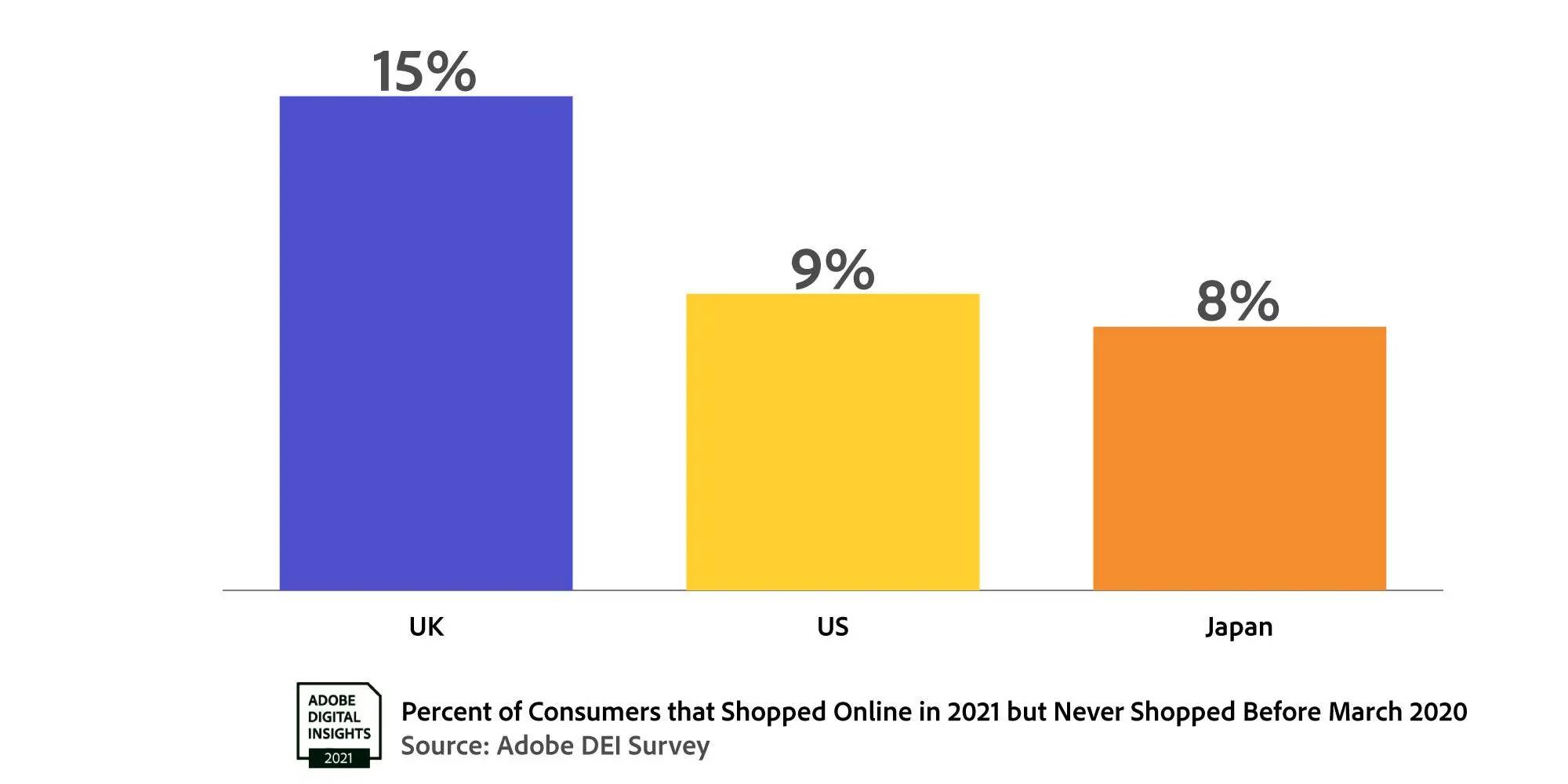

The pandemic increased the number of UK online shoppers by 15%: consumers that shopped online in March this year had never bought anything online before lockdown restrictions came into force in March 2020.

Consumers give online shopping the thumbs up: Over 79% are satisfied with their online shopping experience, and even more (83%) state that delivery times of online purchases either meet or exceed their expectations.

Younger age groups indulge in retail therapy: 63% of people said they had shopped online to help relieve stress during the pandemic. This is particularly prominent in GenZ (54%) and Millennials (43%).

Smartphones are the shopping device of choice: Almost half (44%) of UK shoppers favoured smartphones for making purchases.

Many consumers remain cautious about visiting physical stores and most will favour those outlets that retain strict virus protection policies such as mask wearing and social distancing:

45% of people have done more online shopping during the pandemic because they feel it is safer and only 42% say they will attend a shopping centre/mall in the next six months.

26% of consumers feel less comfortable visiting physical stores compared with 2020; 27% feel more comfortable.

Following vaccination, 31% plan to spend more time in stores than they do currently, but shoppers remain cautious. 53% will favour stores that enforce strict virus protection policies, like requiring masks to enter, limiting numbers and conforming to social distancing guidance.

42% anticipate the online/in-store shopping habits formed during lockdown to remain the same when things return to more normal, pre-pandemic conditions.

More consumers said they shopped online for safety reasons, than because it provided greater choice, value and convenience: 47% said they shopped more online “to avoid crowds” and 45% said “because it was safer”, compared with 26% that said it was to get the best price; 26% because it was an “easier way to shop”; and 20% to get the best selection.

40% of consumers plan to actively avoid physical stores altogether.

Over the next 6 months more UK consumers are planning to visit pubs, bars and restaurants than shopping centres. 44% plan to visit pubs, bars and restaurants compared with 42% that intend to visit shopping centres or malls.

Appetite for travel is high, but most will stick to the staycations:

Providing it remains possible, allow, 64% plan to travel in the next six months. Of those that do intend to travel, 77% expect to holiday in the UK, 28% expect to travel to Europe and 14% expect to travel internationally.

A significant 63% of people plan to travel by car and 38% will stay with family and friends; just 46% are planning to stay in a hotel and 28% plan to rent a holiday apartment.

Download the full Digital Economy Index report here.

Source : Adobe