Hotel reservations surpass pre-pandemic levels; Growth in flight bookings slows

Image source: Adobe Stock / Jag_cz.

After a year where travel virtually came to a standstill overnight, all eyes are on the airline and hotel industry. An increase in vaccinations and consumer confidence have unleashed some pent-up demand, but the lack of business travel is beginning to slow the comeback we’ve seen since January 2021. Adobe is issuing the latest travel data and spending insights:

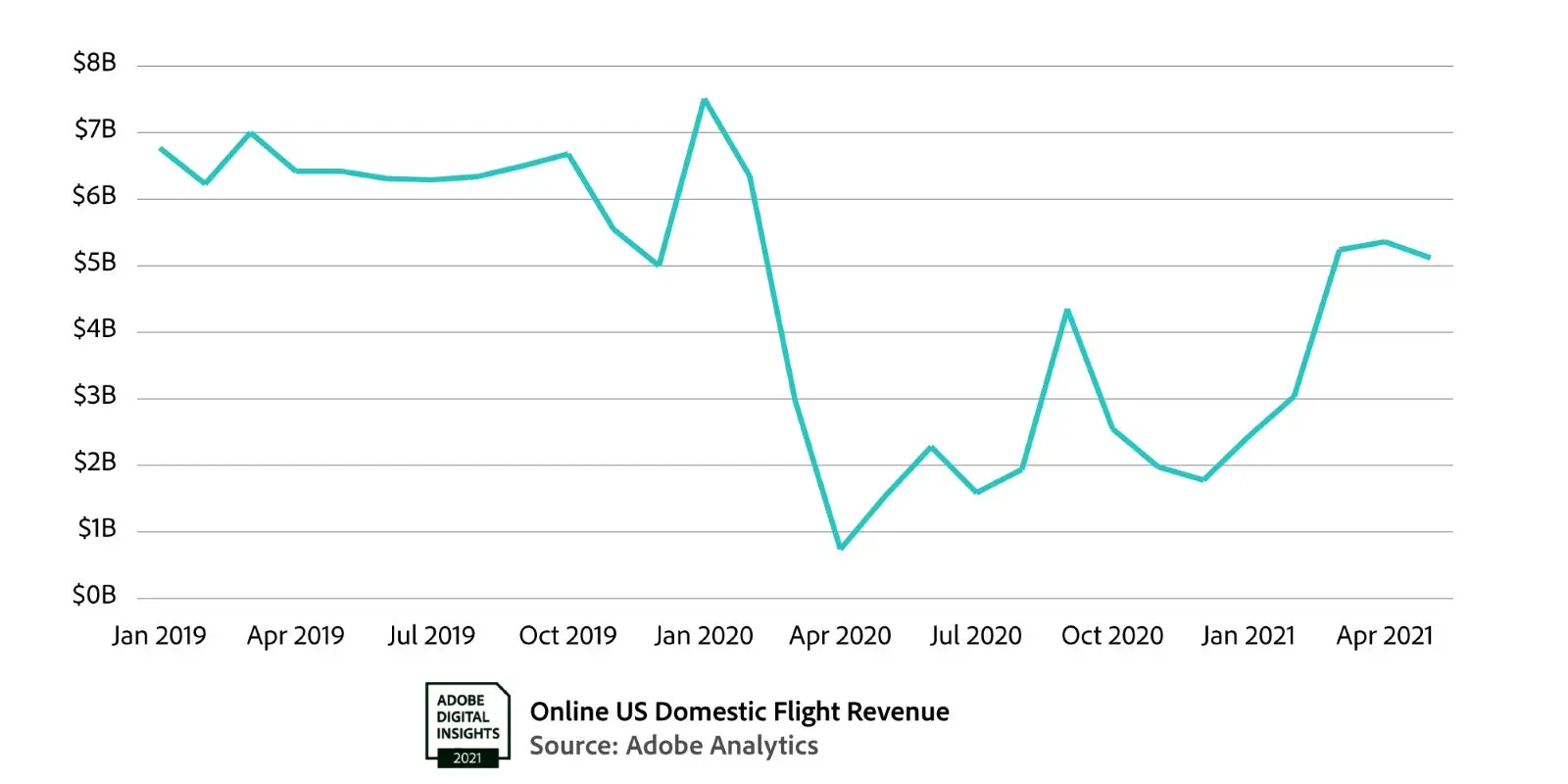

Domestic flight bookings drove $5.1 billion in online spending in May 2021, which represents a 4 percent decrease from the month prior (April 2021). This is the first month this year where flight bookings growth began to plateau, after a steady rise beginning in January of the new year. Spend in May 2021 is down significantly (20 percent) compared to May 2019, which drove $6.4 billion in spend. As consumers use past flight credits, it’s putting a dent in the bottom line.

So far this year (Jan – May 2021), a total of $21.2 billion has been spent for domestic flights, down 35 percent compared to the same period in 2019, which netted $32.9 billion.

The lack of business travel (as companies take a careful approach to re-opening) and lingering consumer hesitation are prolonging the road to recovery. In a survey of over 1,000 US consumers, Adobe found that only 11 percent plan to travel for work in the next 6 months. At the same time, 29 percent still don’t feel safe traveling at all.

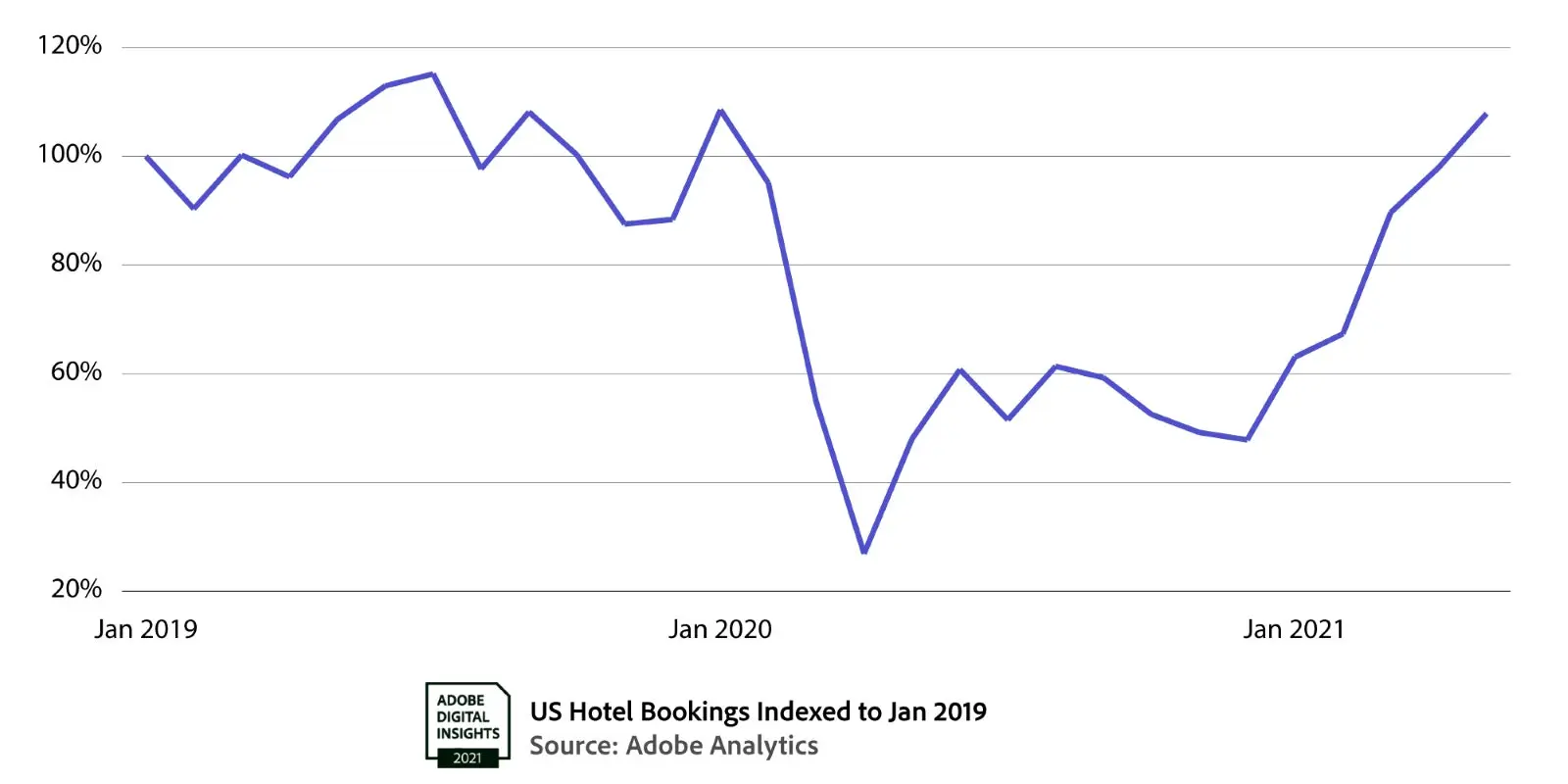

Hotel bookings on the other hand, have recovered faster than flights. April 2021 was the first month where bookings exceeded 2019 levels by 2 percent (May exceeded by 1 percent). In Adobe’s survey, 57 percent feel safe staying in a hotel and 58 percent intend to do so when traveling in the next 6 months. As prices rise in the sharing economy, consumers have renewed interest in hotels and familiar amenities.

Other Adobe Analytics insights include:

Top 10 destinations (domestic): Looking at the arrival sites for flight bookings, Hawaii tops the chart this Summer. Bozeman, Montana (a 90-minute drive from Yellowstone), rounds out the top 5:

Maui, Hawaii

Kona, Hawaii

Kaua’l, Hawaii

Bozeman, Montana

Honolulu, Hawaii

Nantucket, MA

Orlando, FL

Fort Meyers, FL

Richmond, VA

Las Vegas, NV

Top 10 destinations (International): Due to country-by-country restrictions, popular travel destinations like London haven’t made the list, yet. Instead, US travelers are staying close and venturing to places like Mexico, Puerto Rico and Jamaica. In Adobe’s survey however, only 8 percent plan to travel internationally in the next 6 months. The top destinations include:

Cancun, Mexico

San Juan, Puerto Rico

Baja, Mexico

Montego Bay, Jamaica

Puerto Vallarta, Mexico

Santiago, Dominican Republic

Santa Domingo, Dominican Republic

Oranjestad, Aruba

St. Thomas, US Virgin Islands

Cana, Dominican Republic

Flight prices are still deflated in May 2021 (down 8 percent compared to May 2019) but are creeping up. In April 2021 for instance, prices were down 13 percent vs April 2019. Consumers, anxious about prices going up, are hitting “buy” more frequently; conversion rates for flights are up significantly in May 2021 (17 percent) vs May 2019.

Holiday travel: More and more consumers are solidifying their holiday plans earlier, as many missed out on the opportunity in 2020 with lockdowns. Flight bookings for November and December 2021 are 30 percent higher than they were at this point in 2019, a significant jump.

Travel accessories (Commerce insights): As more people dive back into traveling, it is also driving growth for other categories. Luggage sales in May 2021 were up 9 percent compared to May 2019. Swimsuits saw a big jump at 40 percent (places like Hawaii and Mexico top the list of popular destinations) and camping gear is up a whopping 130 percent (Yellowstone near Bozeman, Montana is another top domestic destination).

Hitting the road: Consumers are also traveling by car more than they were two years ago. In May 2021, sales of auto parts were up significantly at 161 percent over May 2019 levels. And for the small slice of people traveling for work, Adobe’s survey showed that 53 percent planned to do so by car, while 37 percent would get on an airplane.

Methodology: The Adobe Digital Economy Index offers the most comprehensive set of insights of its kind, based on analysis through Adobe Analytics that covers over 150 billion visits to travel, leisure and hospitality sites — measuring transactions from 6 of the top 10 U.S. airlines and 8 of the top 10 U.S. hotels (more than any other technology company). Commerce insights cover over one trillion visits to U.S. retail sites via Adobe Analytics and over 100 million SKUs in 18 product categories. Companion research is based on a survey of 1,000 U.S. consumers (18 years or older) fielded between June 2 and June 6, 2021.

Source : Adobe