Get ahead of tax planning for 2021 with Adobe Acrobat tools

Contents

Tackle tax planning early this year

Even in more normal times, May 17 is for many people one of the most dreaded days of the year. This time around, the COVID-19 pandemic has thrown finances into uncertainty and caused changes to the normal tax filing routine, adding additional stress. That’s why it’s smart to get a head start on your tax planning and preparations this year, and Adobe Acrobat online tools are here to help you organize your documents. With some forethought and early action, you can enter tax season feeling prepared and confident.

Tax season 2021: Important dates and logistics

Start your 2021 tax planning by adding important dates and deadlines to your calendar. Here are some of the most important tax deadlines for individuals:

● January 15, 2021

Estimated tax payments for Q4 2020 are due. Only individuals who do not pay their income taxes through withholding (or didn’t pay enough in tax that way) need to submit estimated tax payments.

● January 31, 2021

Individuals who pay estimated tax but did not meet the January 15 payment deadline can avoid any late payment penalties by filing their 2020 tax return by this date, along with payment of the Q4 2020 installment.

By this date, all businesses must have filed and issued a Form W-2 for each employee with tax withholdings in 2020 or a Form 1099 for recipients of qualifying payments made in 2020.

● May 17, 2021

Completed 2020 Form 1040 is due for all individuals with income tax withholdings during 2020.

Q1 estimated taxes for 2021 are also due for all individuals who pay estimated tax.

Keep in mind that these are only the key federal tax dates for individuals under certain tax situations. The IRS generally begins to accept and process tax returns near the end of January, so you can likely file your completed federal return any time after you’ve received all your W-2s and/or Form 1099s for the year.

It’s also smart to pre-plan how you will prepare and submit your tax forms. If you’ve prepared and filed on your own before and feel comfortable doing so again, that’s great. You may also choose to engage an independent tax preparer, work with a business that offers income tax services, or use tax preparation software on your own. Each of these options typically come with a service fee, but any individual whose 2020 adjusted gross income (AGI) is less than $72,000 is eligible for free electronic filing through the IRS.

How COVID-19 could impact your tax return

The coronavirus pandemic has brought changes to nearly all aspects of life, and tax planning is no different. Both the federal and state governments have taken economic action to address the crisis, which may affect your tax return. Below are some of the most likely COVID-related tax considerations, but you can get comprehensive information about federal coronavirus tax relief for individuals and businesses from the IRS.

Individual taxes

The most common coronavirus-related tax consideration for individuals is the federal government’s disbursement of Economic Impact Payments, which began in April 2020. Qualifying individual filers are eligible for a $1,200 payment, while those married and filing jointly are eligible for $2,400 plus $500 for each qualifying child.

If you’ve already received your full Economic Impact Payment, there is no action you need to take on your 2020 federal tax return. If you are eligible but have not yet received this payment, or received only a portion of it, you may be able to apply the Recovery Rebate Credit to your 2020 tax return.

The other major coronavirus-related tax consideration for individuals is whether you received unemployment benefits this year. Unemployment benefits you’ve received must be reported as gross income on your tax return, but whether or not they are taxable depends on the program through which you received those benefits. The IRS provides an online tool to help determine whether your unemployment benefits will be taxed.

Business taxes

The federal CARES Act established various tools to help businesses weather the economic fallout of the COVID-19 pandemic, including the Paycheck Protection Program (PPP) and the Employee Retention Credit (ERC). Businesses can either receive a Small Business Administration loan through the PPP or claim the ERC, but not both.

Loans granted through the PPP are eligible for forgiveness, but only if receiving businesses meet employee retention criteria and follow SBA guidelines for how those funds can be spent. Critically, however, business expenses paid with PPP loan funds are not tax-deductible if payment of the expenses would result in forgiveness of the loan. The CARES Act also stipulates that forgiven PPP loans can be excluded when calculating federal gross income.

If your business has not received a PPP loan, the ERC provides a tax credit of 50 percent of up to $10,000 in qualified wages, which includes the cost of employer-provided health care. The IRS provides a detailed FAQ about the program for those businesses interested in claiming the ERC.

Finally, the increase in unemployment claims due to the coronavirus pandemic has caused many business owners to worry that their unemployment insurance tax liability will also increase. Whether employers will be charged for coronavirus-related unemployment claims depends on what state they are in, so check the website of your state’s governor or labor department for more information if you’re uncertain about how your business’s unemployment insurance tax liability will be affected.

Tax filing tips and tools

Once you’ve got a handle on tax timing and how COVID-19 could affect your tax liability, it’s time to start preparing your tax materials for filing. Whatever your tax situation, some basic tax filing tips and tools can help you make the process as simple as possible.

Personal tax filing

Gather your information: Most income is taxable, so be sure that you have gathered any and all W-2s, 1099s, and other records of income, such as those from unemployment income or gig work. If you received an Economic Impact Payment, you’ll also need your Notice 1444, which indicates the amount received and helps determine eligibility for the Recovery Rebate Credit.

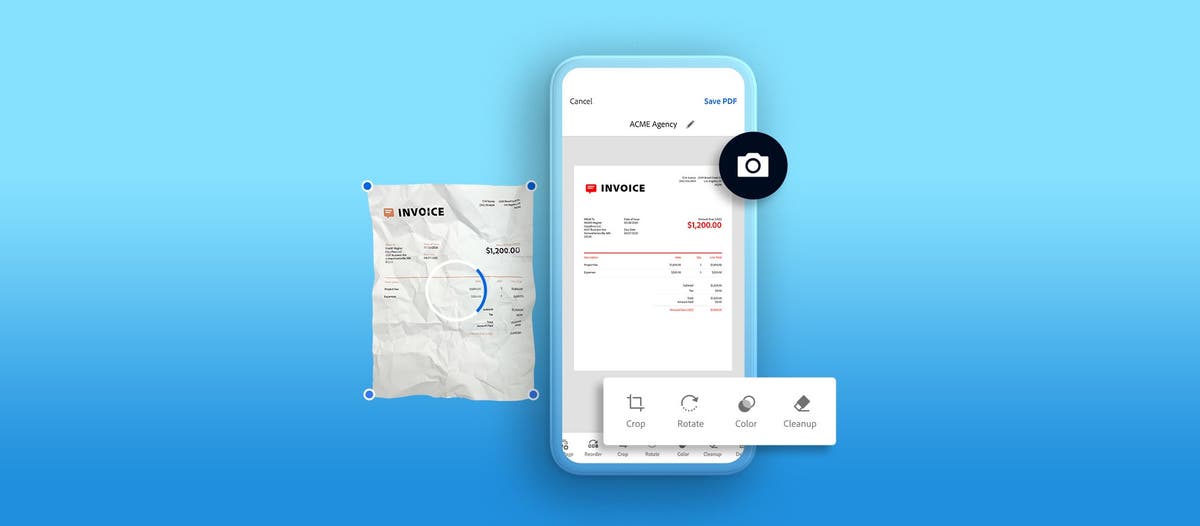

Organize your documents: Filing will be as smooth as possible if you can locate specific forms and documents quickly. Consider digitizing paper documents using Adobe Scan — a free, easy-to use mobile app. With Adobe Scan, you can take a picture of each tax document, rename it for easy filing, and save it as a PDF to Adobe Document Cloud for quick access from anywhere.

Reference your previous return: One simple way to complete your tax return faster is to have last year’s return on hand. This lets you quickly find and duplicate information that stayed the same since last year.

Choose how to file: Based on the complexity of your income and your confidence in performing tax calculations, you can choose to prepare and submit a paper return on your own, to file online using a guided tax program, or to file through a tax professional. If you choose to have someone else prepare your return, it is especially important that all of your tax documents are well-organized.

Small business tax filing

Organize your documents: A well-managed business should take care to keep all pertinent tax documents together throughout the year, but now is a good time to double check that you have what you need. This includes records of all business income and expenses, including business bank account interest. If these records are in a variety of formats and locations, consider trying the Acrobat online Convert to PDF tool or other Acrobat conversion tools to create a document in your preferred format. If you have an existing Acrobat subscription, you can do even more with your documents, including combining files, reorganizing pages in a PDF, and redacting private information.

Itemize business expenses: After you’ve organized your business records, take time to carefully itemize and categorize your expenses. This will allow you to complete your tax return efficiently, and help you identify the tax deductions and credits for which your business is eligible. Try online Acrobat tools like Reorder PDF Pages and Edit PDF to help organize your documents and annotate files for additional context.

Understand applicable deductions and credits: Taking advantage of deductions and credits is one of the most important parts of the tax filing process for businesses. A tax professional can help you identify deductions and credits applicable to your business.

Research COVID-specific tax questions: If your business received a loan through the PPP, speak with a tax expert to understand whether it is eligible for forgiveness or whether non-forgiven portions are applicable toward deductions. If you did not apply for a loan through the PPP, you should check with a tax professional to see if it makes sense to claim the Employee Retention Credit. Additionally, you should understand how your state plans to calculate business contributions to its unemployment insurance fund to budget for future contributions.

Simplify tax season with Adobe Acrobat

May 17 is on its way, but with the tax tips and resources above, you’ll be ready to tackle tax season. You can also try Adobe Acrobat Pro DC free for seven days, then US $14.99/mo., to better manage all of your documents — thanks to the power of PDF.

Disclaimer: Information on this page is intended to help individuals and business owners understand some tax implications when filing taxes during the pandemic. Adobe is not providing any tax advice, and you should consult a tax expert regarding your specific tax questions and to understand the relevant up-to-date U.S. tax laws and regulations. To the maximum extent permitted by law, Adobe provides this material on an “as-is” basis. Adobe disclaims and makes no representation or warranty of any kind with respect to this material, express, implied or statutory, including representations, guarantees or warranties of merchantability, fitness for a particular purpose, or accuracy.

Source : Adobe